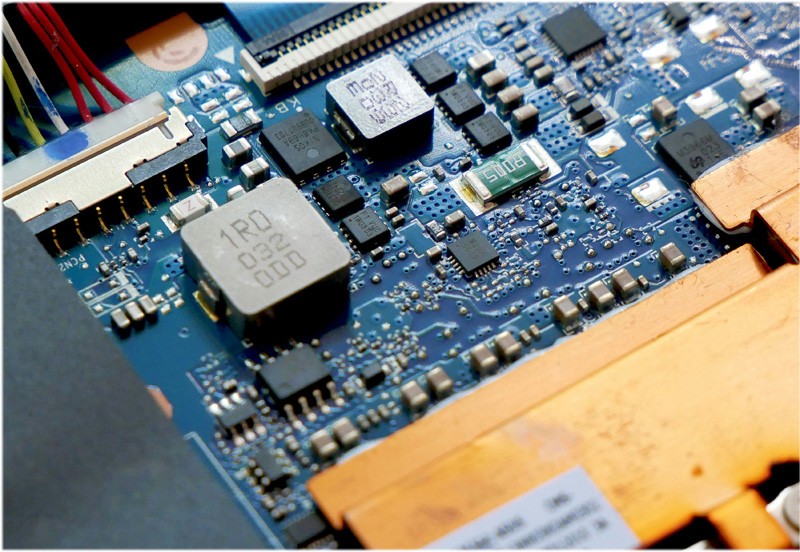

India’s ambitious semiconductor manufacturing plan

Just as the Government of India has prioritised the construction of roads to connect the country, it has embarked on an ambitious plan to make India self-sufficient in the production of semiconductor chips.

The latest milestone in this strategy was the approval, on 29 February 2024, of proposals for three new semiconductor manufacturing facilities.

This is part of a larger plan to create a domestic industry for making these critical components. Construction on all three facilities is expected to begin within the next 100 days.

The significant point here is the involvement of private industry, which the government has encouraged.

The other point is that many new units in the JV mode will come up across India to improve reliability and redundancy, making India gradually a world leader in this field.

India’s Semiconductor Mission (ISM) was launched in December 2021 to develop a domestic ecosystem for manufacturing semiconductors and displays.The Mission aims to make India a major player in this field with a budget of Rs. 76,000 crores.

Significantly, the government approved a proposal (June 2023) from the US firm Micron to build a semiconductor facility in Sanand, Gujarat. Once completed,this facility is expected to spur the growth of a strong semiconductor ecosystem.

Significantly, this initiative has propelled several private players to invest in the semiconductor field.The ISM has thus far achievedseveral milestones.

There has been a surge of interest from major semiconductor companies around the world.

The Indian government has announced financial incentives totalling US$ 7 billion for several new semiconductor manufacturing facilities, including collaboration with Micron.

Additionally, India is actively attracting foreign companies like Foxconn and AMD to set up local operations.

This comprehensive plan is designed with a 20-year timeframe that has potential to leverages India’s existing pool of 300,000 design engineers who already contribute to the global chip design landscape.

Which leads us to the situation on the ground. While construction of the Micron facility is underway in Gujarat, Tata Electronics Private Limited (TEPL) has partnered with Powerchip Semiconductor Manufacturing Corp (PSMC) from Taiwan to build a semiconductor fabrication facility in Dholera, Gujarat.

This will have a production capacity of 50,000 wafers starts per month (WSPM) and focus on creating chips for various sectors like high-performance computing, electric vehicles, and consumer electronics with a total investment for this project is estimated to be Rs. 91,000 crores.

The TEPL plant is expected to begin construction in about three months.

The Tatas plan to build another semiconductor plant at Morigaon, Assam.

Tata Semiconductor Assembly and Test (TSAT), plans to build this new facility at an estimated cost of Rs. 27,000 crores.

The TSAT facility will focus on three main technologies: Wire Bond, Flip Chip, and Integrated Systems Packaging (ISP). The company is developing its own advanced packaging technologies, including flip chip and ISIP (integrated system in package).

Once operational, the facility will have a daily production capacity of 48 million units and cater to various sectors, including automotive, electric vehicles, consumer electronics, telecom, and mobile phones.

It is also expected to generate over 27,000 jobs, both directly and indirectly.These will create components for various industries, including automotive, communications, and electronics. Construction is expected to begin this year, with the first part of the facility opening in mid-2025.

Notably, Gujarat continues to be favoured location for new semiconductor plants. For instance, CG Power has joined forces with Renesas Electronics from Japan and Stars Microelectronics from Thailand to build a new semiconductor facility in Sanand, Gujarat, India at an investment of Rs.7,600 crore.

Renesas, a major player in specialized chips, will provide the technological expertise.

The facility will manufacture chips for various sectors including consumer electronics, industrial applications, automobiles, and power.

It is expected to have a production capacity of 15 million units per day.Further, a JV between Murugappa group, Renesas Electronics and Stars Microelectronics is planned to establish a semiconductor assembly and testing facility in Gujarat.

In a significant development, Israeli chipmaker Tower Semiconductor is nearing the final stages of securing approval for an US$ 8 billion fabrication plant in India.

This would be the first instance of a top global company participating in India’s $10 billion chip manufacturing initiative.

The government is aiming to approve the proposal before the upcoming general elections.

These developments highlight India’s growing presence in the global semiconductor landscape.Samsung Semiconductor India Research has opened a new R&D facility in Bengaluru, focusing on cutting-edge research.

Additionally, the government’s Design-Linked Incentive Scheme is supporting domestic companies.

Saankhya Labs and SensesemiTechnologies received approval under this scheme, allowing them to develop advanced solutions for various applications, including 5G, satellite communication, and medical devices.

As India embarks on this ambitious journey, ISM, the indigenous development of advanced packaging technologies leads the way.

In essence, ISM is a transformative step in the nation’s technological growth and generate employment. The newly planned units are expected to create 20,000directjobs, alongside an estimated 60,000 indirect jobsacross industries.

ISM will significantly boost employment in downstream sectors that rely on semiconductors, such as automotive, electronics, telecommunications, industrial manufacturing, and many others.

The government is focusing on capturing the market share in the 28 nanometer and above chip segment, which is still in high demand for various applications.

The government of India’s approach, focused on talent development, comprehensive chip design, and international collaborations, positions India for global semiconductor prominence.

As India strides ahead in this field, there are important lessons to be learnt on the public-private partnership in the semiconductor field and how a push by the government has enabled the industry to work faster.

This is a major step forward for India which had previously struggled to attract global semiconductor companies.

It is also important because most of the world’s chip manufacturing is currently concentrated in a few countries, such as China, Taiwan, and South Korea.

The combination of indigenouslycreated chips and ability to attract major global players to invest in India is a heady combination that indicates that India is ready for the high road as far as semiconductors are concerned.

(Photo Courtesy: Unsplash)