Karma strikes back: The fall of Hindenburg Research

The Legacy of Market Mayhem Founded in 2017 by Nathan Anderson, Hindenburg Research made headlines for its explosive reports targeting companies accused of unethical practices. From Nikola Corporation to India’s Adani Group, the firm thrived on controversy, often triggering market crashes that wiped billions off the books of its targets.

Yet, as the firm now announces its closure, questions linger over its motivations and methods.

Anderson’s stated reason for shutting down—a personal decision to “move on”—has not quelled suspicions about the timing.

Observers are linking the move to anticipated regulatory changes under the upcoming Trump administration, which promises closer scrutiny of financial entities tied to market disruptions.

This marks a stunning turn of events for a firm that prided itself on being an industry watchdog but leaves behind a trail of chaos.

Billion-Dollar Losses, Billion-Dollar Gains

Hindenburg’s most infamous attack was on India’s Adani Group. In January 2023, the firm accused the conglomerate of decades of stock manipulation and accounting fraud.

The fallout was severe: Adani’s market value plunged by over $100 billion within 10 days.

The timing of this report, coinciding with India’s growing global influence, fueled suspicions of a coordinated effort to destabilize the nation’s economy.

However, resilience is a hallmark of the Adani Group. Shares in most of its 10 listed companies rebounded, with some touching record highs by the end of 2024. Adani stocks have emerged as top wealth creators over the past five years.

Adani Enterprises ranks among the 10 largest, fastest, and most consistent wealth generators.

Adani Green, from 2019 to 2024, stands out as one of the most consistent wealth creators, while Adani Power is also recognized as one of the fastest wealth generators.

This recovery is a testament to the inherent strength of the Indian economy and the robustness of its industrial giants.

The Global Game Behind Hindenburg’s Moves

Hindenburg’s operations were not confined to financial markets. Allegations have surfaced that the firm had ties to foreign entities, possibly linked to China, and acted as a tool for broader geopolitical agendas.

Critics argue that its reports often coincided with sensitive moments in global politics, raising questions about whether the firm’s actions were part of a larger strategy.

For instance, the Organized Crime and Corruption Reporting Project (OCCRP) and George Soros-linked entities have been implicated in funding Hindenburg.

This nexus suggests a deliberate effort to undermine emerging markets, including India, to maintain global power hierarchies.

Even Kingdon Capital Management, which had a profit-sharing arrangement with Hindenburg, has faced scrutiny for alleged ties to actors with questionable motives.

Hindenburg’s downfall also shines a spotlight on domestic enablers who amplified its narratives.

In India, opposition parties, notably the Congress, seized on Hindenburg’s allegations to attack the ruling government and its flagship economic policies.

Rahul Gandhi’s statements about fighting not just the BJP but also the Indian state reflect a troubling willingness to prioritize political gains over national stability.

This behavior aligns with a broader trend where political factions inadvertently or deliberately align with external entities to undermine national progress.

By using the Hindenburg report as a political weapon, these groups disregarded its questionable motivations and the collateral damage to India’s global reputation.

The ‘Trump Effect’ and the Endgame

The timing of Hindenburg’s closure is far from coincidental.

The imminent return of Donald Trump’s pro-business administration has sent shockwaves through entities like Hindenburg, which thrived under more lenient regulatory regimes.

Trump has been openly critical of short-selling practices and entities linked to financial manipulation.

Just days before Anderson’s announcement, Republican lawmakers demanded that the U.S. Department of Justice investigate Hindenburg’s operations.

This, coupled with revelations about its ties to hedge funds like Kingdon Capital, suggests that the firm’s closure is less a voluntary retreat and more an escape from impending accountability.

A Nexus of Profit and Power

The revelations about Hindenburg’s ties to hedge funds and its profit-sharing agreements underscore the firm’s dual agenda.

While it claimed to champion transparency and accountability, its actions often resulted in financial windfalls for a select few, including its backers.

This hypocrisy lays bare the true nature of its operations—a profit-driven enterprise masquerading as a crusader for justice.

Moreover, the connections to Soros-backed organizations and allegations of Chinese influence paint a picture of a firm deeply embedded in global power struggles. These linkages raise uncomfortable questions about the role of financial entities as tools of geopolitical strategy.

Hindenburg’s Retreat and the Dawn of a New Age

The saga of Hindenburg Research offers valuable lessons for nations like India. First, it underscores the need for robust safeguards against external attacks on financial markets. Regulatory bodies like SEBI must be equipped to detect and neutralize such threats promptly.

Second, it highlights the importance of unity in the face of external aggression. Political factions must recognize that amplifying unfounded allegations from questionable sources can have long-term repercussions for national stability and growth.

Finally, it calls for greater scrutiny of financial entities operating under the guise of transparency. Nations must demand accountability for the damages caused by such firms, not just domestically but on global platforms.

Hindenburg Research’s closure marks the end of a tumultuous chapter in global finance.

While Nathan Anderson’s farewell note hints at plans to open-source the firm’s methods, it’s unlikely to erase the skepticism surrounding its legacy.

For India, the end of Hindenburg represents more than just vindication for the Adani Group. It’s a reminder of the nation’s resilience and the need to remain vigilant against future threats.

As global markets adjust to this development, the spotlight now turns to similar entities that could face challenges under the new U.S. administration.

The closure of Hindenburg is not just a retreat; it’s an admission of guilt, a tacit acknowledgment of its role in a broader agenda to destabilize markets and target emerging powers.

For the Adani Group and India, this is not just a victory but an opportunity—to rebuild, to grow, and to lead. And for the rest of the world, it’s a cautionary tale about the dangers of unchecked financial piracy.

The era of Hindenburg is over, but its lessons should not be forgotten.

(Author SP Vashist is a New Delhi-based geo-economic expert)

IBNS

Senior Staff Reporter at Northeast Herald, covering news from Tripura and Northeast India.

Related Articles

Indian Army builds third Bailey Bridge in Sri Lanka, restores critical link after Cyclone Ditwah

The Indian Army has constructed a third Bailey Bridge, measuring 120 feet, at KM 15 on the B-492 Highway in Sri Lanka’s Central Province, restoring a crucial link damaged by Cyclone Ditwah.

Papa, save me: Techie dies after car plunges into water-filled basement in Greater Noida

A 27-year-old software engineer died after his speeding car plunged into a water-filled basement near Sector 150 in Greater Noida late Friday night, police said.

INS Sagardhwani flags off for ‘Sagar Maitri V’ mission — What the Indian Navy is signaling

INS Sagardhwani, India’s oceanographic research vessel under the Naval Physical and Oceanographic Laboratory (NPOL) of DRDO, was flagged off for the fifth edition of the Sagar Maitri (SM-5) initiative from Southern Naval Command, Kochi on 17 Jan 2026.

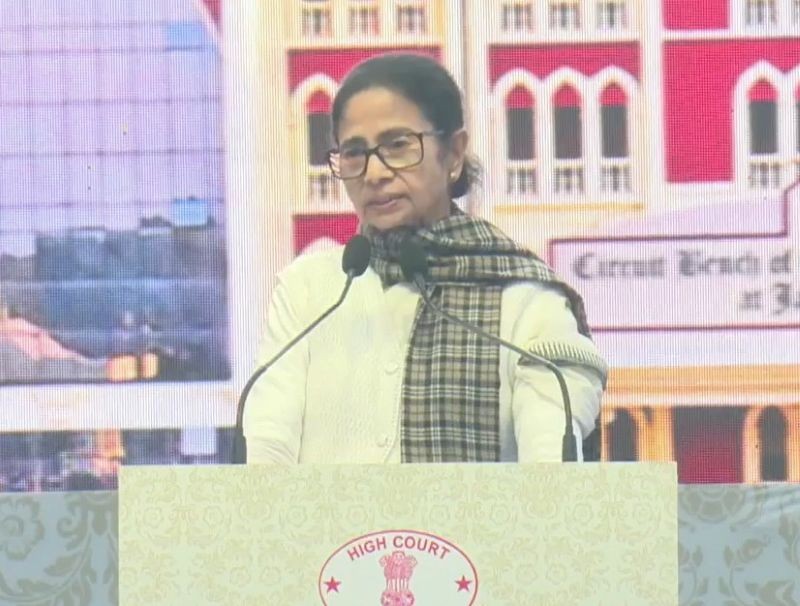

Mamata Banerjee appeals to CJI for protection from ‘targeting’ by agencies amid ED row

Days after walking out with documents and a laptop during Enforcement Directorate (ED) raids on political consultancy firm I-PAC, and subsequently being issued a notice by the Supreme Court, West Bengal Chief Minister Mamata Banerjee on Saturday urged the Chief Justice of India to protect citizens from what she described as being “targeted” by central agencies.

Latest News

Massive fire in Pakistan's Gul Plaza kills six, sparks safety concerns across Karachi

India brings investments, Pakistan doesn’t: Trump's Republican Party members' sharp message

Indian Army builds third Bailey Bridge in Sri Lanka, restores critical link after Cyclone Ditwah

Papa, save me: Techie dies after car plunges into water-filled basement in Greater Noida