JP Morgan gives 'overweight' rating to Adani Group bonds

Mumbai: US investment bank JP Morgan has assigned an 'overweight' rating to four bonds issued by the Adani Group, citing the group's capacity to scale and grow through internal cash flows, which reduces the likelihood of credit stress.

In its report, JP Morgan rated three bonds of Adani Ports & SEZ and one from Adani Electricity Mumbai Ltd (a subsidiary of Adani Energy Solutions Ltd) as 'overweight.' It maintained a neutral stance on five other Adani bonds and assigned an 'underweight' rating to a bond issued by Adani Green Energy Ltd.

JP Morgan categorizes its bond ratings into three groups: 'overweight,' equivalent to a buy recommendation; 'neutral,' akin to a hold recommendation; and 'underweight,' which is comparable to a sell recommendation.

Discussing potential risks, the report noted that Adani bonds might perform better than expected if there is a swift resolution of US SEC and Department of Justice allegations against founder-chairman Gautam Adani and key aides over bribery charges, successful refinancing of upcoming bonds and credit facilities, and improved operational performance.

The Adani Group has dismissed the charges as baseless.

Following initial volatility, "spreads of the group's bonds, (since action by US authorities), seem to have settled, widening by about 100-200 basis points, with short tenor seeing more spread widening due to higher dollar prices," JP Morgan stated.

The report also highlighted near-term offshore debt maturities across several Adani entities, including Adani Ports, Adani Green, Adani Airport Holdings (fully owned by Adani Enterprises), Ambuja Cement bidco entities, and Adani Energy Solutions.

Regarding Adani Green, it noted, "Overall, we take varying degrees of comfort, and believe that key to watch among the bond-issuing entities are mainly Adani Green, which has a decent-size loan (USD 1.1 billion) due in March 2025."

Although the bonds are not secured by collateral, JP Morgan emphasized their robust cash flows.

"Our preference is for cashflows over security," remarked Love Sharma of JP Morgan in the report.

The ability of Adani Ports to scale and grow using internal cash flows provides "strong comfort on the intrinsic equity value of such a business, which in turn reduces the scope for credit stress," the report added.

Upside risks to JP Morgan's neutral rating include "a quick resolution of the SEC/DoJ charges; successful refinancing of the upcoming bonds and credit facilities; and improved operating performance," the report stated.

Conversely, downside risks to its 'overweight' and 'neutral' ratings include an adverse outcome from the SEC/DoJ cases, related-party transactions within the group, and debt-funded mergers or capital expenditure leading to weaker credit metrics.

IBNS

Senior Staff Reporter at Northeast Herald, covering news from Tripura and Northeast India.

Related Articles

CRR cut, AI ethics push, and SORR benchmark: Experts hail RBI’s pragmatic policy moves

Mumbai: The Reserve Bank of India (RBI) has kept the repo rate unchanged at 6.5% while the cash reserve ratio (CRR) has been slashed by 50 basis points to 4 percent, media reports said.

LG Electronics files DRPH with SEBI; IPO size expected to be over RS 15,000 cr

Mumbai: South Korean electronics giant LG Electronics has filed a draft red herring prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) on Friday for the proposed public listing of its Indian business, according to a notification on the Bombay Stock Exchange (BSE).

De-dollarisation not on India's agenda; derisking domestic trade is: RBI Governor Shaktikanta Das

Mumbai: India has not initiated any steps towards de-dollarisation and is solely focused on mitigating risks to domestic trade from geopolitical uncertainties, Reserve Bank of India (RBI) Governor Shaktikanta Das clarified on Friday, media reports said.

Vodafone Idea to consider Rs 2,000 crore equity raise on December 9, eyes tariff adjustments

Mumbai: Vodafone Idea announced it will consider raising up to Rs 2,000 crore through a preferential equity issuance to a promoter entity during a board meeting scheduled for Monday, December 9, media reports said.

Latest News

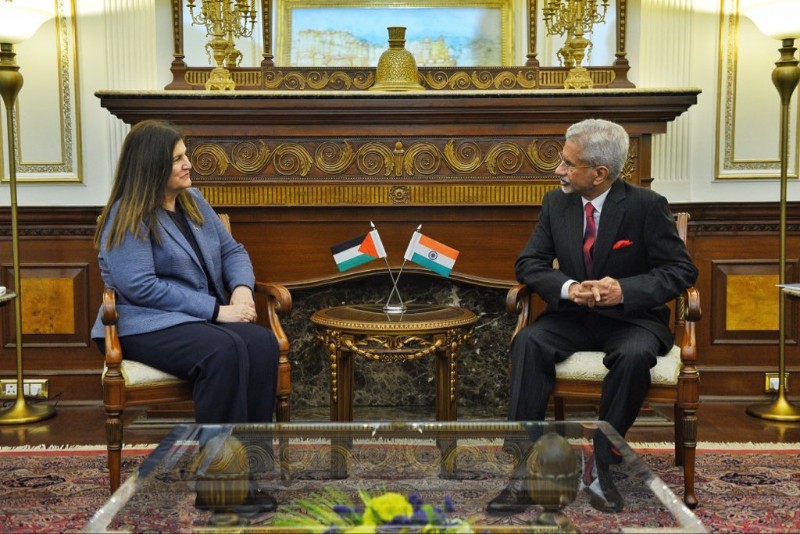

India will decide independently: Palestine FM on Gaza ‘Board of Peace’ invitation

EU labels Iran's Revolutionary Guards as 'terrorist organisation' amid deadly crackdown on protests

Pakistan, Bangladesh resume direct flights after 14 years, check out how internet users reacted

Economic Survey reveals disturbing reality: Are ultra-processed foods and obesity, screen time destroying India’s future?