CRR cut, AI ethics push, and SORR benchmark: Experts hail RBI’s pragmatic policy moves

Mumbai: The Reserve Bank of India (RBI) has kept the repo rate unchanged at 6.5% while the cash reserve ratio (CRR) has been slashed by 50 basis points to 4 percent, media reports said.

RBI governor Shaktikanta Das made the announcement on Friday.

This is the 11th consecutive time when the repo rate has been kept unchanged.

The RBI has kept the repo rate unchanged at 6.5% since February 2023, when it last increased the rate to its current level.

SBI Chairman CS Setty described the monetary policy announcements made today as “pragmatic, candid and has crossed important milestones in regulatory and development policy space”.

The cut in CRR by 50 bps, raising the FCNR (B) deposit rates, development of the Secured Overnight Rupee Rate (SORR) benchmark and revision in limit of collateralised agriculture loans are all positive for banks.

The decision to form a committee to investigate the issue of ethical AI in financial services and use of technology to detect mule accounts is timely, he added.

Bandhan Bank Chief Economist and Head of Research Siddhartha Sanyal said, “The CRR cut will inject large quantum of liquidity almost immediately. One feels going ahead, it might be important for RBI to continue monitoring banking system liquidity condition closely and continue to provide support for durable liquidity in order to support growth in credit to the productive sectors of the economy.

The revision in RBI’s growth and inflation forecasts are in line with expectations. The RBI reiterated their confidence about better growth momentum in the second half of the financial year. Importantly, the central bank continues to be more confident about stronger momentum in rural India.

V. P. Nandakumar, MD & CEO at Manappuram Finance noted, “Cutting the CRR to 4% is not only positive for the banking sector as their profits on M-T-M portfolio will improve significantly, it will also support the broader economy by ensuring adequate system liquidity which will see money market interest rates evolving in an orderly fashion. By doing so, the MPC has done a fine balancing act by supporting growth without lowering its inflation vigil.”

IBNS

Senior Staff Reporter at Northeast Herald, covering news from Tripura and Northeast India.

Related Articles

JP Morgan gives 'overweight' rating to Adani Group bonds

Mumbai: US investment bank JP Morgan has assigned an 'overweight' rating to four bonds issued by the Adani Group, citing the group's capacity to scale and grow through internal cash flows, which reduces the likelihood of credit stress.

LG Electronics files DRPH with SEBI; IPO size expected to be over RS 15,000 cr

Mumbai: South Korean electronics giant LG Electronics has filed a draft red herring prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) on Friday for the proposed public listing of its Indian business, according to a notification on the Bombay Stock Exchange (BSE).

De-dollarisation not on India's agenda; derisking domestic trade is: RBI Governor Shaktikanta Das

Mumbai: India has not initiated any steps towards de-dollarisation and is solely focused on mitigating risks to domestic trade from geopolitical uncertainties, Reserve Bank of India (RBI) Governor Shaktikanta Das clarified on Friday, media reports said.

Vodafone Idea to consider Rs 2,000 crore equity raise on December 9, eyes tariff adjustments

Mumbai: Vodafone Idea announced it will consider raising up to Rs 2,000 crore through a preferential equity issuance to a promoter entity during a board meeting scheduled for Monday, December 9, media reports said.

Latest News

Washington Post publisher and CEO Will Lewis steps down after mass layoffs

USA shock start, Suryakumar’s masterclass seals India’s T20 WC opener

Germany rules out Greenland consulate as France expands diplomatic footprint

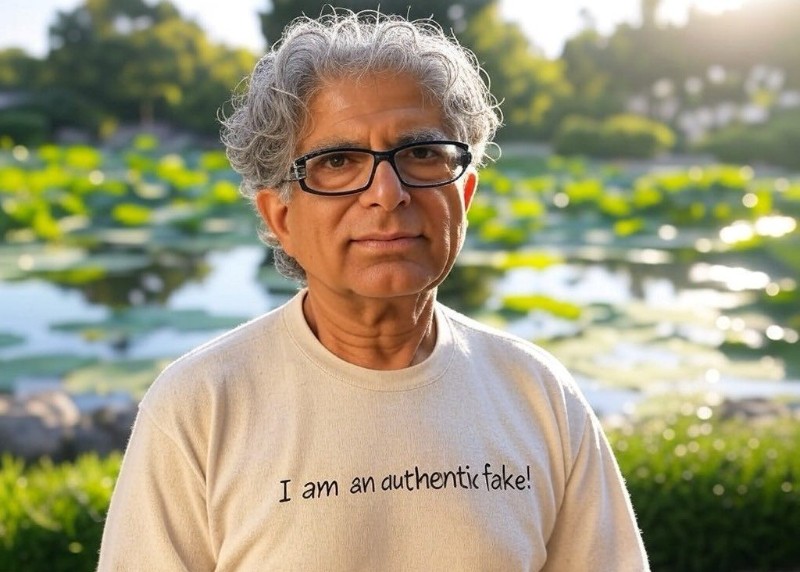

Epstein emails, celebrity names and Deepak Chopra: Why the spiritual guru is facing tough questions