GST Council tweaks rates for range of products and services

New Delhi: Union Finance Minister Nirmala Sitharaman presided over preliminary discussions with finance ministers from states and Union Territories to gather their perspectives ahead of the upcoming Budget.

This was followed by the 53rd meeting of the GST Council on Saturday.

The GST Council has decided to exempt services related to hostel accommodation outside educational institutions up to Rs 20,000 per person per month, with the condition that the student must have stayed in the hostel continuously for at least 90 days.

This condition aims to prevent hotels from misusing the exemption.

Furthermore, the purchase of railway tickets and payments for waiting room and cloak room charges are now exempt from GST.

Similarly, GST will not be applicable to services provided by battery-operated vehicles and intra-railway services.

Additionally, the GST Council recommended waiving interest on penalties related to tax demand notices and set a uniform GST rate of 12 percent on milk cans.

During the pre-Budget meeting, Sitharaman emphasised the Central government's commitment to supporting states through timely tax devolution and settling GST compensation arrears to stimulate economic growth.

She encouraged states to make use of the scheme where the Centre offers a 50-year interest-free loan for implementing specific reforms.

IBNS

Senior Staff Reporter at Northeast Herald, covering news from Tripura and Northeast India.

Related Articles

CRR cut, AI ethics push, and SORR benchmark: Experts hail RBI’s pragmatic policy moves

Mumbai: The Reserve Bank of India (RBI) has kept the repo rate unchanged at 6.5% while the cash reserve ratio (CRR) has been slashed by 50 basis points to 4 percent, media reports said.

JP Morgan gives 'overweight' rating to Adani Group bonds

Mumbai: US investment bank JP Morgan has assigned an 'overweight' rating to four bonds issued by the Adani Group, citing the group's capacity to scale and grow through internal cash flows, which reduces the likelihood of credit stress.

LG Electronics files DRPH with SEBI; IPO size expected to be over RS 15,000 cr

Mumbai: South Korean electronics giant LG Electronics has filed a draft red herring prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) on Friday for the proposed public listing of its Indian business, according to a notification on the Bombay Stock Exchange (BSE).

De-dollarisation not on India's agenda; derisking domestic trade is: RBI Governor Shaktikanta Das

Mumbai: India has not initiated any steps towards de-dollarisation and is solely focused on mitigating risks to domestic trade from geopolitical uncertainties, Reserve Bank of India (RBI) Governor Shaktikanta Das clarified on Friday, media reports said.

Latest News

India–Spain relations in spotlight as Spanish Foreign Minister meets President Murmu

Cricket’s big stars are coming to Europe: Steve Waugh, Maxwell and Abhishek Bachchan back ETPL!

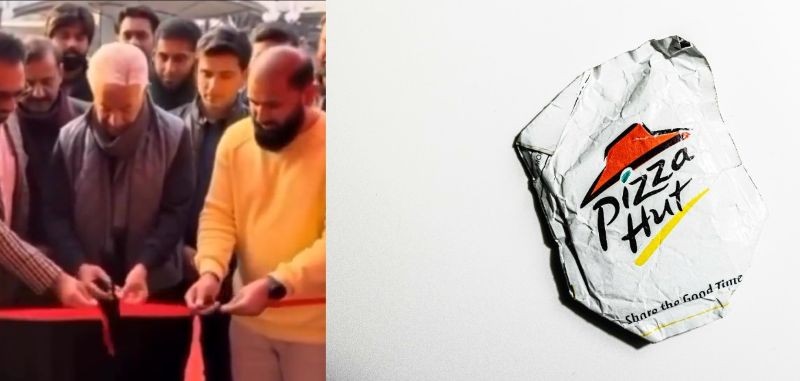

Pizza Hut shock in Pakistan: Defence Minister Asif inaugurates ‘fake’ outlet, company cries fraud

Trump's Air Force One to Davos takes U-turn after takeoff — what went wrong?