RBI alerts investors about 'deepfake videos' of Governor Shaktikanta Das circulating on social media

Mumbai/IBNS: The Reserve Bank of India (RBI) on Tuesday (Nov. 19) issued a warning to investors regarding the circulation of deepfake videos featuring Governor Shaktikanta Das on social media.

These videos falsely claim to promote or support RBI-backed investment schemes, misleading viewers into making financial decisions.

The RBI clarified in an official statement that these deepfake videos are designed to give fake investment advice, encouraging people to invest in fraudulent schemes by using advanced AI technology to create the illusion of authenticity.

“Fake videos of the Governor are being circulated on social media, which falsely claim the launch of or support for certain investment schemes by RBI. These videos are attempting to influence the public to invest in these schemes using technological tools,” the RBI said.

Deepfake technology uses artificial intelligence (AI) to create realistic but fabricated photos, videos, and even audio, often making it difficult to distinguish them from genuine content.

The term "deepfake" comes from "deep learning," a form of AI that enables the creation of highly convincing fake media.

The RBI made it clear that none of its officials are involved in these activities and stressed that such videos are entirely fake.

"RBI clarifies that its officials are not involved in or endorsing any such activities, and these videos are fake. The RBI does not offer financial investment advice of this nature," the central bank emphasised.

The RBI further urged the public to be cautious and avoid engaging with or sharing these deceptive videos, advising investors to stay alert to protect themselves from falling victim to such scams.

IBNS

Senior Staff Reporter at Northeast Herald, covering news from Tripura and Northeast India.

Related Articles

CRR cut, AI ethics push, and SORR benchmark: Experts hail RBI’s pragmatic policy moves

Mumbai: The Reserve Bank of India (RBI) has kept the repo rate unchanged at 6.5% while the cash reserve ratio (CRR) has been slashed by 50 basis points to 4 percent, media reports said.

JP Morgan gives 'overweight' rating to Adani Group bonds

Mumbai: US investment bank JP Morgan has assigned an 'overweight' rating to four bonds issued by the Adani Group, citing the group's capacity to scale and grow through internal cash flows, which reduces the likelihood of credit stress.

LG Electronics files DRPH with SEBI; IPO size expected to be over RS 15,000 cr

Mumbai: South Korean electronics giant LG Electronics has filed a draft red herring prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) on Friday for the proposed public listing of its Indian business, according to a notification on the Bombay Stock Exchange (BSE).

De-dollarisation not on India's agenda; derisking domestic trade is: RBI Governor Shaktikanta Das

Mumbai: India has not initiated any steps towards de-dollarisation and is solely focused on mitigating risks to domestic trade from geopolitical uncertainties, Reserve Bank of India (RBI) Governor Shaktikanta Das clarified on Friday, media reports said.

Latest News

'It is Congress who sold nation': Nirmala Sitharaman slams Rahul Gandhi for 'sold Bharat Mata' remark

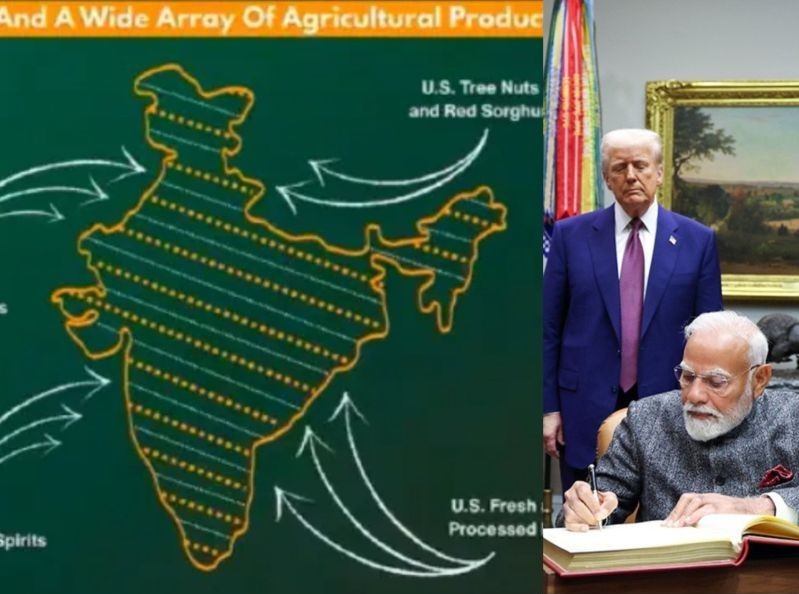

US deletes post featuring map of India showing PoK, Aksai Chin as Indian territory

FAA reopens El Paso Airspace in Texas hours after announcing 10-day closure over drone threat

Salman Khan, Ajay Devgn, other industry figures offer support to Rajpal Yadav after he surrenders in jail